Expenses are amounts paid for goods or services purchased. They can either be directly or indirectly related to the core business operations. The t ype of expense and timing at which it is incurred by the business frames the key points of difference between direct and indirect expenses.

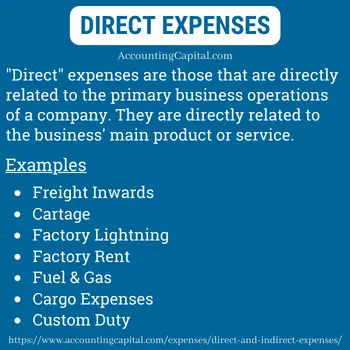

“Direct”, as the word suggests, are those expenses directly related and assigned to the primary business operations of a business. In general, they relate to the purchase and production of goods and services.

They are expenses associated with purchasing goods and delivering them to a business location.

Such expenses are a part of the prime cost or the cost of goods/services sold by a company. They are also called direct costs and are directly related to the production of the main revenue-generating product or service.

They may differ for different types of companies, such as manufacturing companies, construction companies, technology companies, etc.

The main logic to categorising any expense as direct is to ask yourself, “is the cost directly linked and attributable to the primary income-generating product of the company?”. If the answer is “Yes”, then it is most likely a direct expense.

Our team researched and compiled a list of the most commonly seen direct expenses.

General

Service Industry

In the service industry, some commonly seen direct expenses are:

Construction Industry

In the construction industry, some commonly seen direct expenses are:

Direct expenses are not the same as operating expenses

Operating expenses are also known as operating costs, operating expenditures, etc. It is the cost that a business must incur on a day-to-day basis to function properly. Examples: Utility bills, marketing, office supplies, office rent, etc.

On the other hand, direct expenses are those that are incurred in order to manufacture or produce products/services that are then sold in the market to generate income. Examples: Factory rent, factory power, wages, etc.

Note the difference between the words “factory” and “office”.

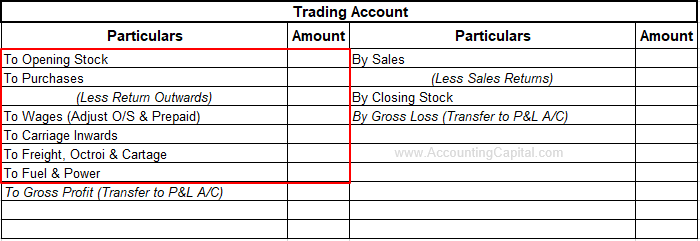

This heading will answer a frequently asked question related to the topic “where are direct expenses shown or entered?”

Direct expenses are shown on the debit side of a trading account because costs related to the production, procurement, buying and selling of goods/services should appear in this account.

This is where the initial gross profit or gross loss is determined.

Intellectual skills, knowledge, expertise, and experience are among the few intangible items a business sells when running operating in the service industry. It does not involve a physical product. Examples: Accounting services, IT consulting, Hospitality, Payroll, Cleaning Business, etc.

Some service industry players need inventory, while others do not. Direct material costs consist of the parts and supplies you use, e.g. a cleaning company would use cleaning supplies, mops, brooms, etc. For such companies, these are direct expenses along with any other necessary costs associated with the action of providing services.

On the other hand, personal service companies such as an accounting firm (e.g. KPMG) may not require to spend anything as direct material costs. For such service,

Direct and Indirect costs can be declared on the income statement as expenditures since a personal service company does not hold inventory.

You can also use an independent “Cost of Sales A/c” to list the expenses on the profit and loss account. As an independent line item, each expense is reported separately.

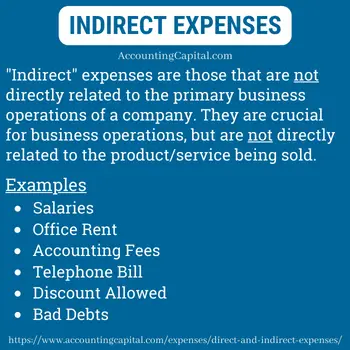

Unlike direct, indirect expenses are not directly related and assigned to the core business operations of a firm. They are also known as Opex or operating expenses.

Indirect expenses are necessary to keep the business up and running, but they can’t be directly related to the cost of the core revenue-generating products or services.

Just like direct expenses, indirect expenses can also be different for diverse organisations. These are usually shared costs among different departments/segments within the firm.

The main logic to categorising any expense as indirect is to ask yourself, “is the cost directly linked and attributable to the primary income-generating product of the company?”. If the answer is “No”, then it is most likely an indirect expense.

Our team researched and compiled a list of the most commonly seen indirect expenses.

As per Wikipedia, overhead or overhead expense “refers to an ongoing expense of operating a business. Overheads are the expenditure which cannot be conveniently traced to or identified with any particular revenue unit”.

Overhead expenses are crucial for business operations, but it is nearly impossible to directly associate them with products or services sold by the firm. They do not play a direct role in generating profits.

Yes, overheads and indirect expenses are mostly similar. However, some overhead costs (exceptions) can be directly related to a product, so a part of such costs may be direct.

For a deeper understanding of this topic, we recommend reading these two concepts on Wikipedia. Overhead Expense & Indirect Costs.

This heading will answer a frequently asked question related to the topic “where are indirect expenses shown or entered?”

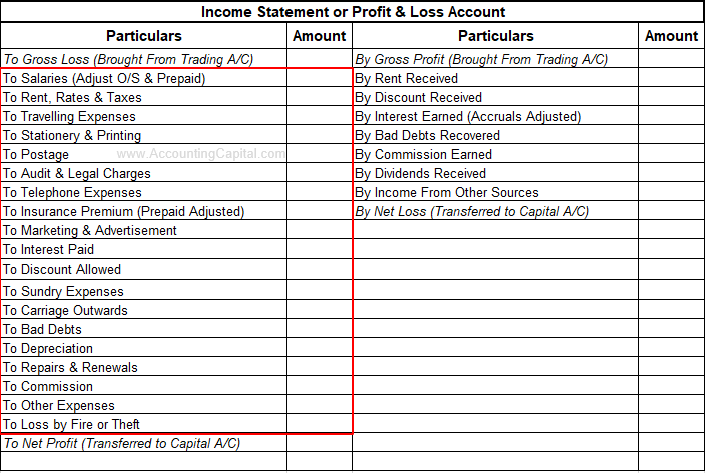

Indirect expenses are shown on the debit side of an income statement this is because costs which are not directly related to the production, procurement, buying and selling of goods/services should appear in this account.

Employers pay salaries to their employees as compensation for the work they perform. If the salary expense can not be directly related to the production of products/services being offered by the company, then it is an indirect expense.

In most cases, salary is an indirect expense shown in the profit & loss account.

Another question asked often is, “Why are wages direct but salaries indirect expense?”

Wages, on the other hand, are payments made for a specific period of time. In the modern scenario, this can be related to freelancers and part-time workers.

Traditionally wages have always been categorized as direct expenses as it is assumed that they are related to the compensation made to the factory workers who help produce the primary selling item for the company.

In contrast, it is presumed that the money paid to other employees (not factory workers) is called salaries. This logic leads to wages becoming direct expenses, as opposed to salary expenses becoming indirect expenses.

Although the situation may be different in today’s world, direct and indirect expenses should be handled according to their respective rules regardless of the expense.

| Direct Expenses | Indirect Expenses |

| 1. Expenses or direct costs incurred while manufacturing the main “product” or “service” of the company are termed direct expenses. | 1. Expenses or indirect costs which are not directly related to the core “product” or “service” of the company are termed indirect expenses. |

| 2. They become a part of the total cost of goods/services sold. | 2. Indirect expenses are not included in the total cost of goods/services sold. |

| 3. Shown on the debit side of a trading account. | 3. Shown on the debit side of an income statement. |

| 4. Direct expenses can be allocated to a specific product, department or segment. | 4. Indirect expenses are usually shared among different products, departments and segments. |

| 5. Examples – Direct labour (wages), cost of raw material, power, rent of factory, etc. | 5. Examples – Printing cost, utility bills, legal & consultancy, postage, bad debts, etc. |